In the fast-paced digital world, the convenience and efficiency of financial transactions are paramount. As technology evolves, so do the methods of transferring money securely. One such innovation making waves in the realm of digital payments is PayID, a revolutionary system that simplifies the process of sending and receiving money.

At Qbit IT Solutions, we’re passionate about leveraging cutting-edge technology to streamline financial processes for businesses and individuals alike. Today, we’re excited to delve into the benefits of PayID and why it’s a superior alternative to the traditional method of using BSB and account numbers.

What is PayID?

First things first, let’s understand what PayID is all about. PayID is a unique identifier linked to an individual’s bank account, which can be easily remembered, such as a mobile number or email address or individuals or ABN for Business. Instead of relying on cumbersome BSB and account numbers, PayID enables users to transfer money quickly and securely using just this simple identifier.

How Does PayID Work?

You can sign up for PayID through your bank’s online banking or app. You can choose your mobile number, email address, or even an ABN (Australian Business Number) to be your PayID.

Once you’ve registered your PayID, you can give it out to friends, family, or businesses instead of your BSB and account number. Payments sent to your PayID should arrive in your account very quickly, usually within minutes.

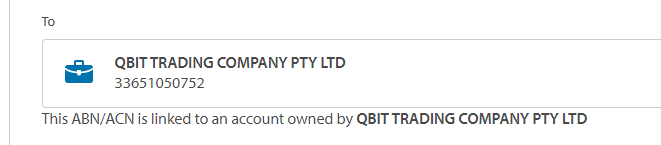

If you want to pay someone using PayID, you’ll need to know their PayID. Most banks offer PayID as a payment option in their online banking platform or app. You simply enter the recipient’s PayID (like their mobile number) and the amount you want to send. Before finalising the payment, you’ll usually see the name of the person or business registered to the PayID, so you can double-check that it’s the correct recipient.

Why PayID?

- Simplicity: Say goodbye to the hassle of remembering lengthy BSB and account numbers. With PayID, you can send money using familiar and easily memorable identifiers like your phone number or email address.

- Speed: Traditional bank transfers often take hours or even days to process. PayID transactions, on the other hand, are usually instantaneous, providing real-time access to funds when you need them most.

- Security: You may be wondering, is PayID safe? PayID transactions are backed by robust security measures, including encryption and authentication protocols, ensuring that your money is safe and protected at all times. PayID shows you who you are paying money to, reducing the chance of making mistakes or being scammed.

This is a screen shot of an ANZ account paying to Qbit, the bank tells you who you are paying too.

This is a screen shot of a Macquarie account paying to Qbit, the bank tells you who you are paying too.

- Convenience: Whether you’re splitting a bill with friends or paying for goods and services online, PayID offers unmatched convenience, allowing you to make payments with just a few taps on your smartphone.

- Compatibility: PayID is supported by a growing number of financial institutions across Australia, making it accessible to a wide range of users and Business.

What action should my business take

Qbit highly recommends setting up PayID with your Bank, it only takes a few minutes and can be done by logging into your bank account and following a few simple instructions. Once you have set it up list it as your preferred payment method on your invoices.

This is how Qbit displays it on it’s invoices.

Links with more information.

How it works – PayID

www.nab.com.au/business/online-banking/payid

PayID for small business owners (commbank.com.au)

How do I set up a PayID®? | Westpac

Conclusion

In a world where convenience and efficiency reign supreme, PayID emerges as a game-changer in the realm of digital payments. By simplifying the process of transferring money and offering unparalleled speed and security, PayID represents the future of financial transactions. Embrace the power of PayID today and experience a new era of convenience and innovation in banking.

General enquiry